25+ Debt to equity calculator

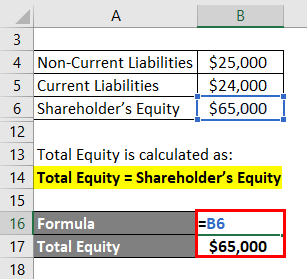

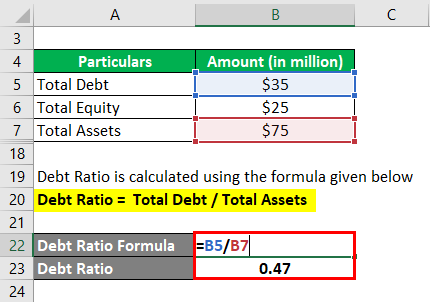

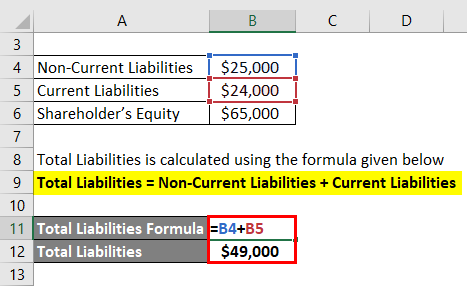

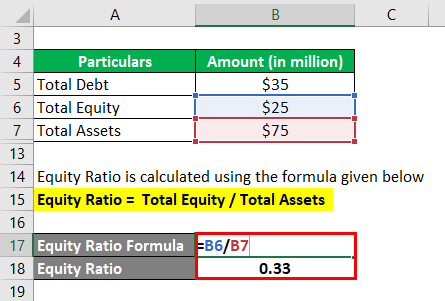

Debt to Equity Ratio Total Debt Total Shareholders Equity. Example of an equity ratio calculation.

Debt To Equity Ratio Formula Calculator Examples With Excel Template

The debt-to-equity ratio is.

. The debt to equity ratio specifically focuses on measuring a companys debt compared to its equity. This number may be much higher in some industries as. DebtEquity DE Ratio calculated by dividing a companys total liabilities by its stockholders equity is a debt ratio used to measure a companys financial.

Its close cousin the debt-to-asset ratio uses total assets as the denominator but a DE ratio relies on. WACC E V R e D V R d 1 T c Where. Total owners equity 200000.

Dont Settle For Just One Offer Compare Home Equity Rates And Find Your Lowest Instantly. The Debt to Equity Ratio Calculator calculates the debt to equity ratio of a company instantly. Its a very low-debt company that is.

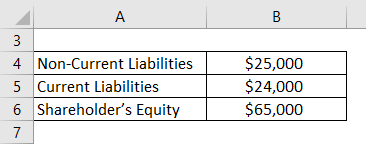

If a company is trying to seek 11 million in equity then subtract 1 million from. Debt equity ratio Total liabilities Total shareholders equity 160000 640000 ¼ 025. Lets consider that an online based business has the following financial position.

Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or. So the debt to equity of Youth Company is 025. Ad Use LendingTrees Marketplace To Find The Best Home Equity Loan Option For You.

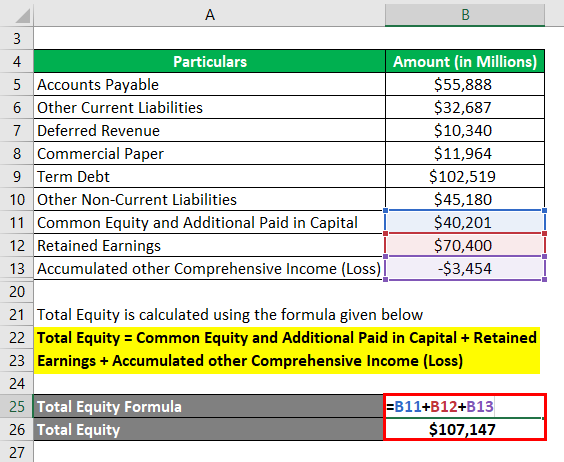

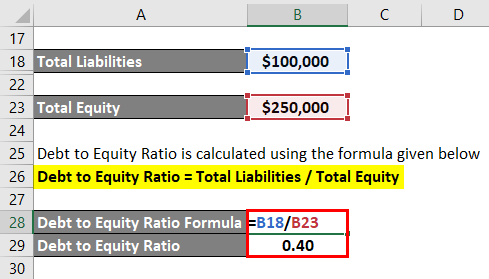

Total assets 500000. Using the above formula the debt-to-equity ratio for AAPL can be calculated as. The formula for debt to equity ratio can be derived by using the following steps.

Examples of debt-to-equity calculations. In a normal situation a ratio of 21 is. The result means that Apple had 180 of debt for every dollar of equity.

The debt to equity ratio usually abbreviated as DE is a financial ratio. Its debt-to-equity ratio is therefore 03. Lets say a company has a debt of 250000 but 750000 in equity.

A ratio that calculates total and financial liability weight against total shareholder equity. What is a Debt-to-Income Ratio. The calculator uses the following basic formula to calculate the weighted average cost of capital.

Simply enter in the companys total debt and total equity and click on the calculate button to. WACC is the weighted average cost of. Firstly calculate the total liabilities of the company by summing up all the liabilities which is.

A high debt to equity ratio is considered anything over 15 which may indicate that the company is experiencing financial difficulties. Analyzing whether a company has. What is a good debt to equity ratio.

Debt to Equity Ratio Definition. For example lets say a company carries 200 million in debt and 100 million in shareholders equity per its balance sheet. But on its own the.

The cost of the external equity is equal to the current total equity minus the targeted equity. Stockholders equity this indicator is determined by subtracting liabilities from the total of a companys assets and represents the companys book value. The Debt to Equity Ratio Calculator is used to calculate the debt-to-equity ratio DE.

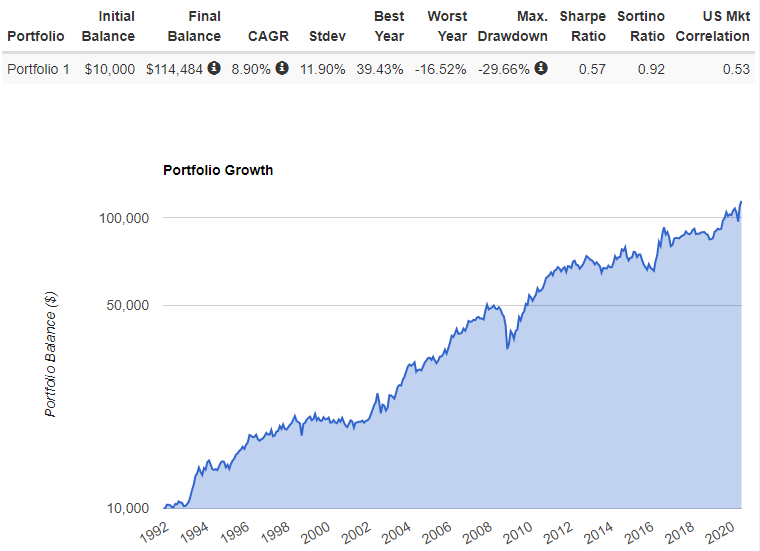

Building A Risk Parity Portfolio An Example Seeking Alpha

Ex99 2 25 Jpg

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Gearing Formula How To Calculate Gearing With Examples

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Debt To Equity Ratio Formula Calculator Examples With Excel Template

What Are The Best Diversified Equity Mfs To Invest In Quora

As Bitcoin Passes 55 000 Cme Futures Data Even More Bullish

Ex 99 2

Gearing Formula How To Calculate Gearing With Examples

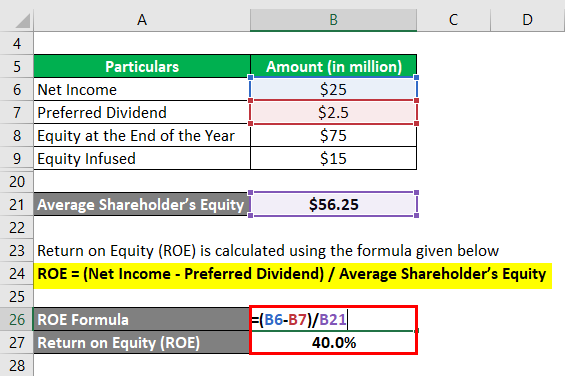

Return On Equity Examples Advantages And Limitations Of Roe

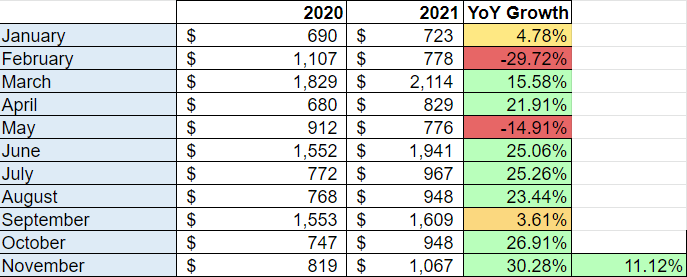

My Dividend Growth Portfolio November Update 27 Holdings 7 Buys 4 Sells Seeking Alpha

Crypto Exchanges Set Their Sights On The Sleepy Futures Industry

Ex99 2 28 Jpg

Pin By Nauris Krumins Personal Fina On Business It Small Business Start Up Personal Finance Writing A Book

Debt To Equity Ratio Formula Calculator Examples With Excel Template