31+ income debt ratio for mortgage

Get Instantly Matched With Your Ideal Mortgage Lender. Apply Today and Get Pre-Approved In Minutes.

What Is The Best Debt To Income Ratio For A Mortgage Bankrate

Apply Get Pre-Approved Today.

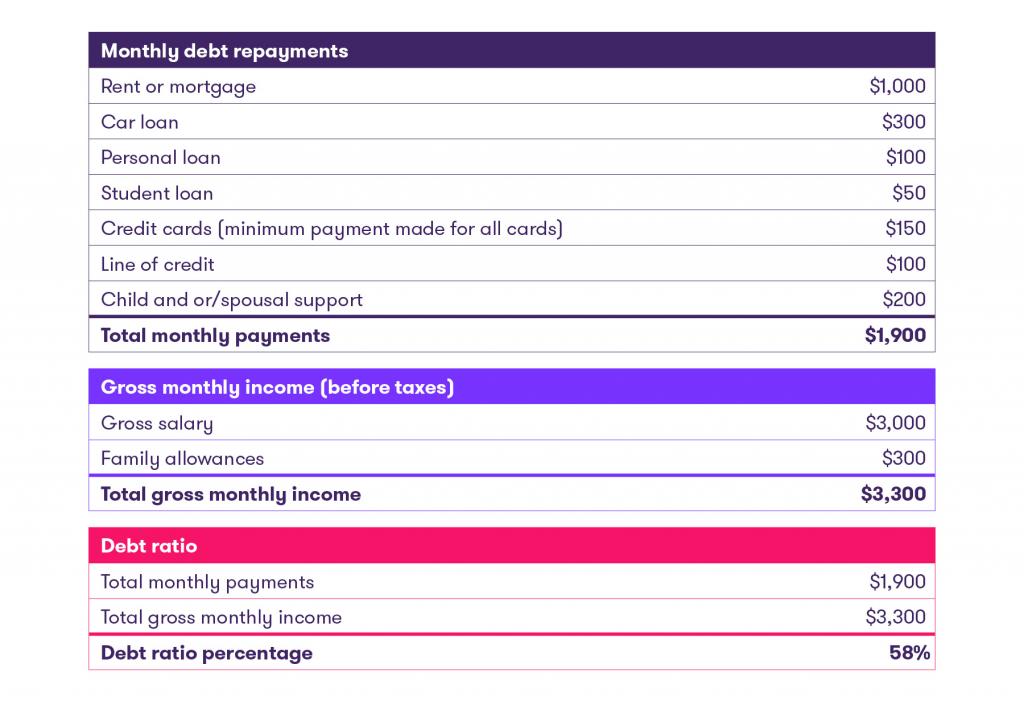

. Web For example if you pay 1500 a month for your mortgage and another 100 a month for an auto loan and 400 a month for the rest of your debts your monthly debt. Ad Use Our Comparison Site Find Out How to Get Home Loan Pre Approval In Minutes. Web To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments.

Ad Compare the Best House Loans for March 2023. Lock Your Rate Today. Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online.

Apply Now With Quicken Loans. Web It could also be called the debt-to-income ratio. Web Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis.

Save Real Money Today. Web The ideal debt-to-income ratio will vary by lender and loan type. Compare Mortgage Options Get Quotes.

In that case NerdWallet recommends an annual pretax income of at least 110820. Get Instantly Matched With Your Ideal Mortgage Lender. Compare More Than Just Rates.

Get Started Now With Quicken Loans. Web Your debt-to-income ratio is an important measurement that lenders use to judge your creditworthiness. Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage.

First Time Home buyerWhat are the fees for purchasing a homeFirst-Time Homeownership TipsAre you a first-time h. Web Homebuyers I cannot stress enough the importance of your Debt-to-Income DTI ratioYour DTI is a crucial factor in determining whether you qualify for a mo. Web Expressed as a percentage a debt-to-income ratio is calculated by dividing total recurring monthly debt by monthly gross income.

Ad Compare the Best House Loans for March 2023. Ad Compare Mortgage Options Calculate Payments. Lock Your Rate Today.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. However you generally want to spend no more than 36 of your gross monthly income on debt. Bank Is One Of The Nations Top Lenders.

Build Financial Confidence With A Conventional Home Loan. A higher ratio could mean youll pay more. Web Gross monthly income of 6500 x 45 2925 can be applied to recurring debt plus housing expenses.

Compare Now Find The Lowest Rate. Web Even if you can realistically afford it taking on a new debt or adding to your credit card balance will only drive up your DTI. Web Understanding Debt-to-Income Ratio for a Mortgage A good DTI ratio to get approved for a mortgage is under 36.

Gross monthly income of 6500. If you have debt a mortgage lender may still approve your application if you. Web If youd put 10 down on a 333333 home your mortgage would be about 300000.

Compare More Than Just Rates. Ideally lenders prefer a debt-to-income ratio. Take Advantage of Low VA Loan Rates.

Find A Lender That Offers Great Service. Find A Lender That Offers Great Service. Web A debt-to-income ratio of 35 or less usually means you have manageable monthly debt payments.

Web How to calculate your debt-to-income ratio. Hold off on pulling the trigger on any. Apply Get Pre-Approved Today.

Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43. Lenders prefer to see a debt-to. Debt can be harder to manage if your DTI ratio falls between.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Get Instantly Matched With Your Ideal Home Loan Lender. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

With a 3143 FHA qualifying ratio. Heres how lenders typically view DTI. Ad Competitive Interest Rates And No Private Mortgage Insurance Mean Lower Monthly Payments.

It looks at your monthly debt obligations in relation to how.

How To Calculate Your Debt To Income Ratio Rocket Money

Debt To Income Ratio Dti What It Is And How To Calculate It

Capital Funding 6 Examples Format Pdf Examples

Debt Ratio And Debt To Income Ratio

Articles Kanakaris Law Firm

How To Calculate Debt To Income Ratio On Mortgage Loans

Lbcer8kex992 2020q4

What S Considered A Good Debt To Income Dti Ratio

What You Should Know About Debt To Income Ratios

Dti Calculator Home Mortgage Qualification Debt To Income Ratio Calculator

Calculated Risk Hamp Debt To Income Ratios Of Permanent Mods

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Pdf Ex Post Evaluation Of The Mfa Operation In The Former Yugoslav Republic Of Macedonia

Calculating And Understanding My Debt Ratio Raymond Chabot

What S An Ideal Debt To Income Ratio For A Mortgage Smartasset

Debt To Income Ratio For Mortgage Definition And Examples

Times Interest Earned Ratio Explained Formula Examples